Ohio Tax Brackets For 2025. However, the deadline for residents of maine and massachusetts is april 17, 2025. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Under ohio’s graduated income tax, the more you make, the more you pay. March 19, 20244 min read by:

See how much Ohio's proposed tax cut would save you; details for, 2025 ohio state income tax rates and tax brackets (taxes filed in 2025) ohio state income tax brackets depend on taxable income and residency status. 4 tax planning ideas to reduce ohio income taxes.

What Are The Different Tax Brackets 2025 Eddi Nellie, Navigating ohio’s new tax changes: The 2025 tax rates and thresholds for both the ohio state tax tables and federal tax tables are comprehensively integrated into the ohio tax.

20242024 Tax Calculator Teena Genvieve, Once fully phased in for 2025, there will be two tax brackets and the highest rate will be 3.50%. Income tax tables and other tax information is sourced from the ohio department of taxation.

Here are the federal tax brackets for 2025 vs. 2025 Narrative News, File a current ohio tax amendment. Ohio income tax brackets for 2025.

What Are The Different Tax Brackets 2025 Eddi Nellie, Calculate your total tax due using the oh tax calculator (update to include the 2025/25 tax brackets). Income tax tables and other tax information is sourced from the ohio department of taxation.

The Best States to Start a Business in 2025 Forbes Advisor, 0.618% of ohio taxable income. Deduct the amount of tax paid from the tax calculation to provide an example.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Under ohio’s graduated income tax, the more you make, the more you pay. Taxpayers earning $26,050 or less will be exempt from paying any.

Irs Tax Brackets 2025 Chart Printable Forms Free Online, Under ohio’s graduated income tax, the more you make, the more you pay. 0.618% of ohio taxable income.

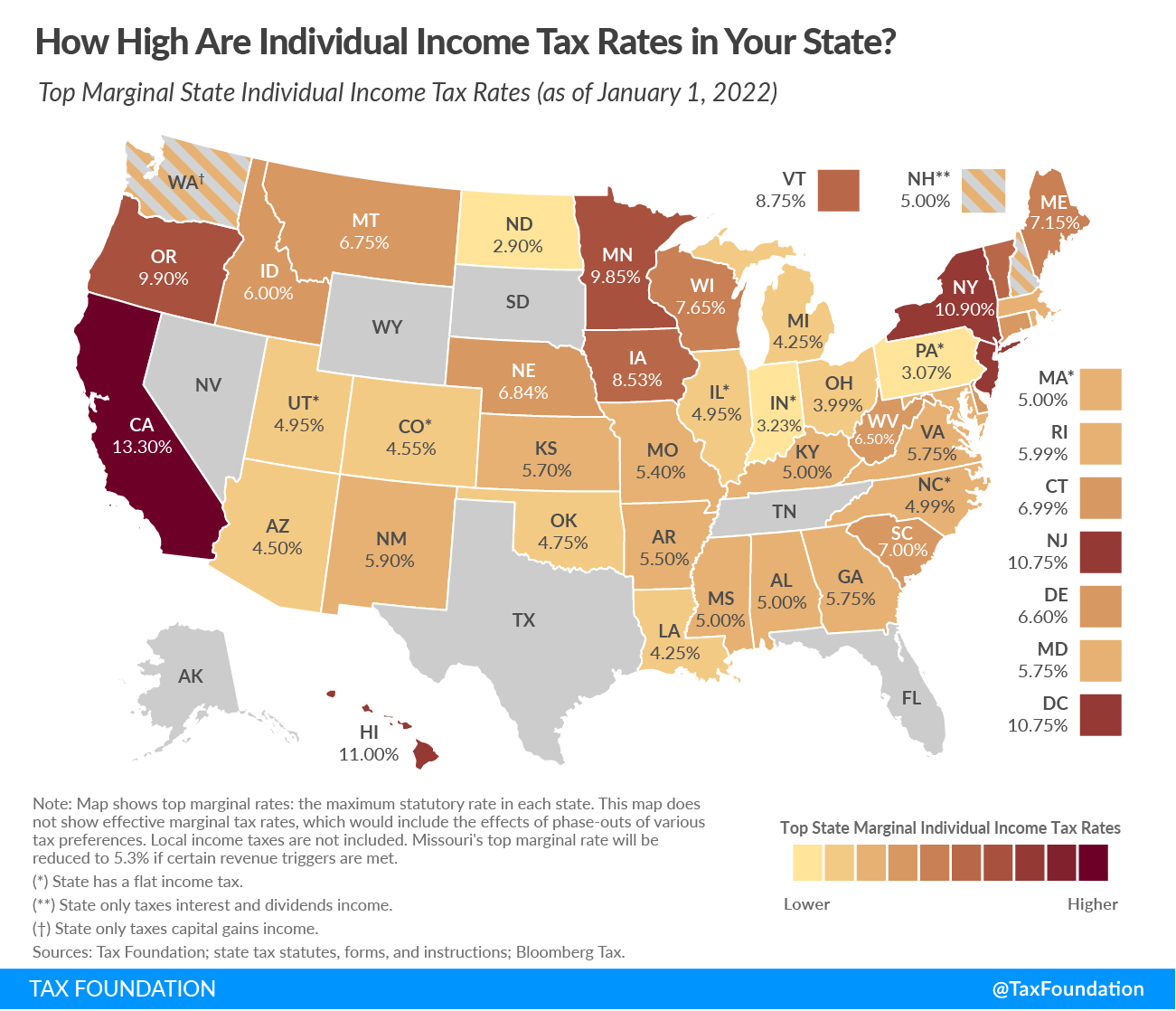

Tax filers can keep more money in 2025 as IRS shifts brackets Andrews, Individual income taxes are a major source of state government revenue, constituting 38 percent of state tax. March 19, 20244 min read by:

Capital Gains Tax Brackets For 2025 And 2025, If you make $70,000 a year living in delaware you will be taxed $11,042. $31.21 + 1.236% of excess of $5,050.

The 2025 tax rates and thresholds for both the ohio state tax tables and federal tax tables are comprehensively integrated into the ohio tax.